Having a trust sounds like something that only wealthy people need, but trusts are useful estate planning tools for regular folks too.

There is a lot of good advice in an article that appeared in The Bryan County (GA) News, “What should you know about trusts.”

“Why would you want a trust? For one thing, if you have specific wishes on how and when you want your estate to be distributed among your heirs, then a trust could be appropriate. Also, you might be interested in setting up a trust if you’d like to avoid the sometimes time-consuming, usually expensive and always public process of probate. Some types of trusts may also help protect your estate from lawsuits and creditors. Currently, only a small percentage of Americans will be subject to estate taxes, but estate-tax laws are often in flux, so things may be different in the future — and a properly designed trust could help minimize these taxes.”

It is important to work with an experienced estate planning attorney to evaluate your needs and to set up any trusts. Trusts are very effective, but they can also be complex. Not all attorneys have the extra training and experience in designing and administering trusts.

NW Legacy Law Center, P.S. does have the focused experience and acumen in estate planning law, business law, and tax law in both Washington and Oregon which works as a perfect combination for anyone in need of estate planning from simple will packages to trusts to business succession incorporating favorable tax strategies.

NW Legacy Law Center, P.S. does have the focused experience and acumen in estate planning law, business law, and tax law in both Washington and Oregon which works as a perfect combination for anyone in need of estate planning from simple will packages to trusts to business succession incorporating favorable tax strategies.

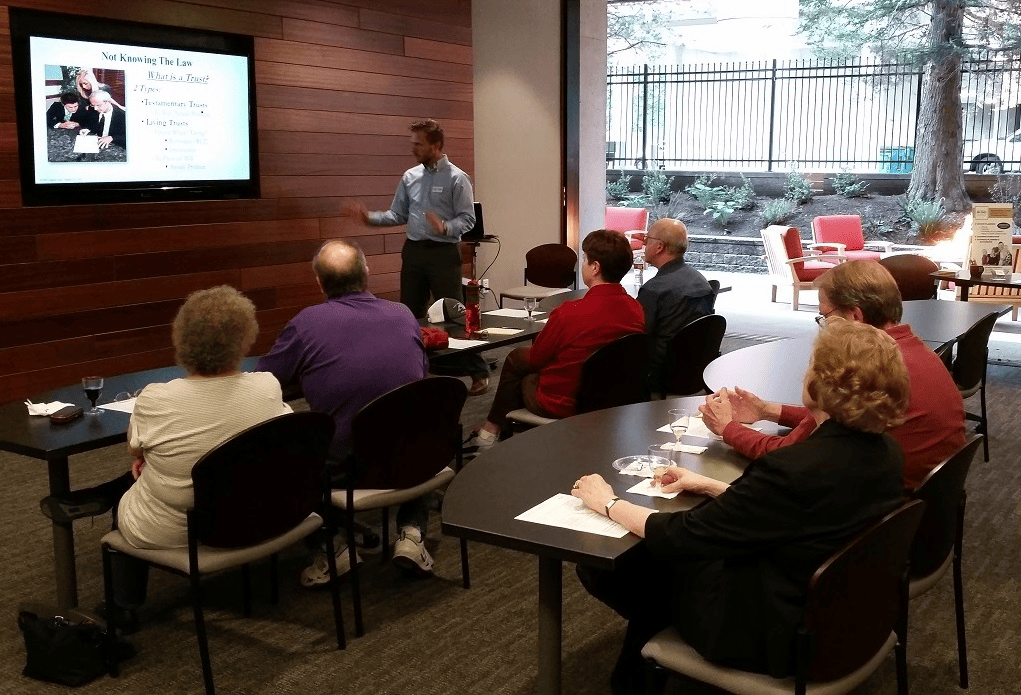

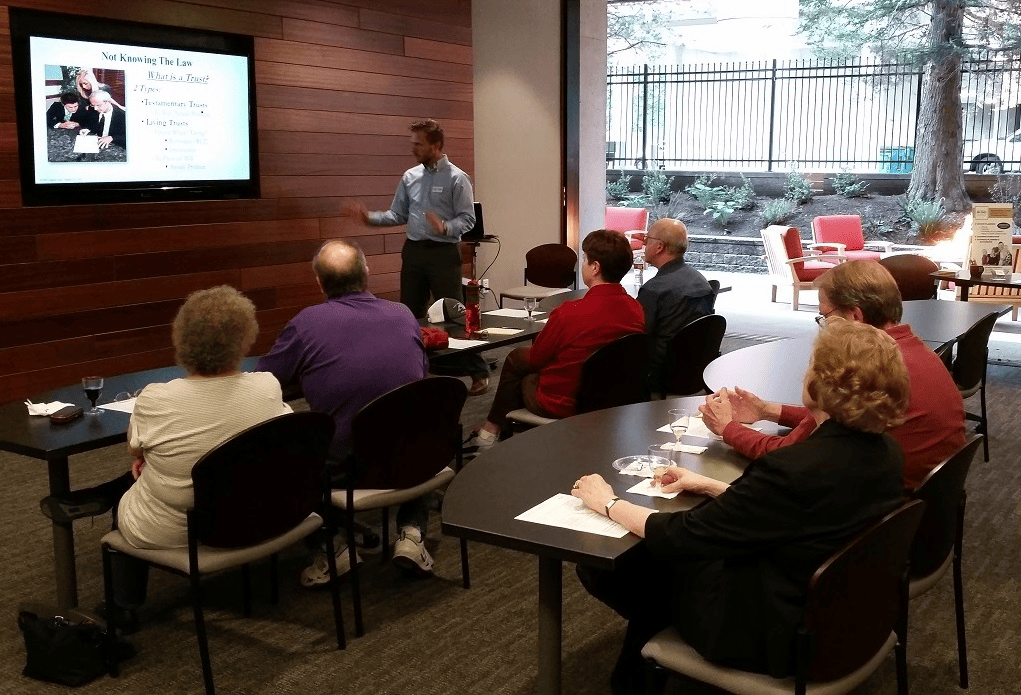

Learn more about our law firm and your estate planning needs at one of our free estate planning Workshops. Attendees are then invited to schedule a complimentary hour with Attorney Thomas Hackett to discuss planning option one-on-one. Please contact us at 360-975-7770 or at info@nwlegacylaw.com to sign up and learn more!

Reference: Bryan County (GA) News (August 2, 2015) “What should you know about trusts”